Fintech Software Outsourcing: Benefits, Best Tips and Trends

Financial technology is evolving at incredible speed. As customer expectations shift and digital-first financial products become the norm, organizations of all sizes are under pressure to modernize quickly. New regulations, security requirements, real-time payments, and advanced analytics continue to redefine how financial services are built and delivered. To keep up, many companies adopt fintech software outsourcing as a strategic approach to accelerate development, reduce costs, and access specialized skills. Outsourcing is no longer only about efficiency. It is also about staying competitive in a market where innovation cycles are shorter and technology capabilities define long-term success. This guide explores the fintech market, key trends, the meaning of fintech software development outsourcing, benefits and challenges, common outsourced services, best practices, and how to choose the right partner.

Fintech Market and Trends

Global fintech market size is projected to exceed $1.1 trillion by 2032. Forecasts show a strong CAGR of 16 to 17 percent from 2025 to 2035, reflecting powerful momentum in innovation, investments, and digital adoption. Asia Pacific is the fastest-growing region thanks to mobile penetration, government support, and large populations shifting from traditional banks to digital platforms.

AI-led fintech alone is expected to grow from over $30 billion in 2025 to more than $83 billion in 2030, proving that artificial intelligence will be a major competitive differentiator this decade.

Meanwhile, embedded finance and modular banking continue expanding across sectors such as healthcare, logistics, retail, travel and education. This leads to higher demand for cloud-native architectures, real-time infrastructure, and secure APIs.

Consumer expectations are also changing. Customers want faster onboarding, personalized advice, and seamless experiences across mobile, web and point-of-sale touchpoints. Fintech companies must innovate rapidly to maintain trust and relevance.

This sustained growth creates a strong foundation for fintech software development outsourcing, where companies rely on external engineering teams to build financial systems with speed, compliance, and advanced technical capabilities.

Key Market and Development Trends Shaping Fintech:

- AI-Driven Transformation: AI automates processes, enhances analytics, strengthens fraud detection, and enables real-time decision-making in lending, payments, and compliance.

- Tokenization of Real-World Assets: Digital tokens enable fractional ownership of real estate, commodities, and securities, increasing liquidity and simplifying investment access.

- Embedded Finance and Composable Architecture: Banking and payments are integrated directly into non-financial apps through APIs, offering seamless user journeys.

- Real-Time Payments and Settlement: Instant payment systems are becoming standard globally, improving speed but requiring stronger fraud controls.

- Cloud-Native Infrastructure: Composable, containerized stacks replace legacy systems to improve scalability, performance, and regulatory compliance.

- Cybersecurity and Cyber Resilience: Fintechs face advanced threats, prompting adoption of adaptive security strategies and real-time monitoring.

- Hyper-Personalization: AI uses data from banking, investments, pensions, and mortgages to deliver tailored offers and dynamic financial insights.

- Sustainability and Decentralization: Green fintech platforms and decentralized finance architectures gain traction, supporting long-term sustainability goals.

- Growing Investments: Funding remains strong, with disciplined investors focusing on profitability, scalability, and compliance-ready technologies.

What is Fintech Software Outsourcing?

Fintech software outsourcing is the practice of partnering with external engineering teams to design, develop, deploy, and maintain financial applications, platforms, and digital services. It allows organizations to access specialized talent, modern technology stacks, and robust delivery practices without expanding internal teams.

Fintech companies often rely on outsourcing to:

- Accelerate development timelines

- Build fintech applications with complex architectures

- Reduce operational and hiring costs

- Access specialized skills such as AI, cloud, blockchain, risk analytics, or cybersecurity

- Ensure compliance with financial regulations

- Modernize legacy systems

- Support product scalability and long-term digital transformation

Fintech organizations outsource development for several reasons:

- Need to integrate automation, AI, and analytics

- Need specialists in cloud-native architecture

- Need strong data security and compliance expertise

- Need rapid scaling for new product launches

- Need expertise in emerging areas like DeFi, embedded finance, tokenization, or smart contracts

In fintech, outsourcing partners often handle full product lifecycle services, including discovery workshops, architecture design, user experience design, API integrations, security implementation, cloud deployment, testing, compliance, and long-term maintenance. These services apply across digital banking, investment platforms, payment engines, financial dashboards, risk assessment systems, and more.

Unlike general IT outsourcing services, fintech software outsourcing requires strict security, domain knowledge, data protection, and compliance with standards such as PCI DSS, ISO 27001, GDPR, AML, KYC, and regional regulations.

Outsourcing partners help companies deliver innovative products while maintaining stability, security, and trust. This model empowers fintech companies to focus more on business strategy, customer experience, and regulatory planning rather than technology staffing.

Benefits of Fintech Development Outsourcing

Fintech organizations partner with external development teams to accelerate growth, strengthen technical capabilities, and respond faster to market demands. Outsourcing creates operational flexibility and delivers measurable business outcomes when executed correctly.

Faster Time-to-Market

Experienced outsourcing teams shorten development cycles. They work with established frameworks, reusable components, and proven delivery practices. This supports rapid product launches and continuous enhancements without slowing down internal operations.

Cost Efficiency

Outsourcing reduces long-term hiring, onboarding, and infrastructure expenditures. Companies pay only for the required expertise, allowing them to allocate budgets more strategically. This is especially valuable for fintech firms managing strict cost controls and regulatory expenses.

Access to Specialized Expertise

Fintech requires skills in AI, cybersecurity, cloud-native systems, blockchain, data engineering, and compliance frameworks. Outsourcing provides immediate access to these capabilities, eliminating long recruitment cycles and talent shortages.

Scalability and Flexibility

Teams can scale up during high-demand phases or scale down when workloads shift. This flexibility helps fintech companies manage unpredictable project timelines, new product releases, or regulatory-driven updates.

Stronger Focus on Core Business

With development handled by a reliable partner, internal teams can focus on growth strategies, customer engagement, compliance, and product innovation. Outsourcing reduces technical distractions and improves strategic execution.

Quality Assurance and Reliability

Outsourcing partners maintain mature QA processes, automated testing frameworks, and structured code reviews. This ensures fintech products remain stable, secure, and compliant across all environments.

Challenges of Fintech Software Outsourcing and How to Overcome Them

Outsourcing fintech software development can yield significant benefits but simultaneously brings its share of challenges. The earlier the identification of these barriers and proactive addressing that can set up your project for success, the better. These are common challenges that have very practical solutions and will be able to make your fintech outsourcing smooth.

Selection of the Correct Vendor

The selection of the appropriate Fintech outsourcing partner is a very important but usually quite difficult decision. Since there are hundreds of firms offering similar services, one may feel swamped when narrowing down the perfect match. It is a very critical decision since an inappropriate partner will lead to delays, miscommunication, and omission of goals.

How to Overcome It? Here, research will be your best friend. Find fintech-experienced companies with proven success in projects of a similar type. Make sure you clearly state your expectations right from the beginning, discussing all your needs openly. Testing your future collaborators through smaller trials or pilot projects is also very useful for assessing their capabilities and compatibility.

Building a Strong Connection

In many cases, effective communication in outsourcing relationships is bound to get strained due to either language barriers, cultural differences, or time zone discrepancies. Such pitfalls make certain misunderstandings and delays unavoidable in projects.

How to Overcome It? To avoid such issues, outsource from regions that have high proficiency in English and established expertise in fintech, such as Central and Eastern Europe. Now, for clear communication, use Slack, Zoom, or Teams. Manipulate the working hours to ensure overlap between your working hours and the working hours of the outsourced team, which could ease collaboration despite a time zone difference.

Maintaining Quality Control

Maintaining quality standards in outsourced fintech development is pretty common, as one has no idea about the development process, so there is every risk of poor output or not exactly deliverables in tune with what one expects.

How to Overcome It? Set clear quality control early in the process by regular code reviews, performance evaluations, and testing. Ensure the outsourced team follows a robust system for quality management. You may work with the vendor in such a way that you remain involved in key decisions while the technical work is carried out by them. Regular check-in helps track progress and address issues before significant problems occur.

Sensitive Data Protection

In FinTech, data security is of paramount concern, and outsourcing software development presents certain risks, including breaches of data disclosure or theft of intellectual property. One should never compromise on safety regarding sensitive financial information.

How to Overcome It? Choose an outsourcing partner that deploys high-security protocols and industry certifications like ISO standards, which ensure that your partners are equipped to handle sensitive information. Deploy comprehensive NDAs and spell out what must be done for security. If at all possible, outline procedures and legal requirements for handling data right at the beginning so that both parties know what they are expected to do.

Managing Expectations

Misaligned expectations of the client and outsourcing team result in frustration, delay, and rework. Poorly defined objectives and deliverables may topple even the best-laid plans.

How to Overcome It? Ensure project objectives, timelines, and deliverables are well-defined and mutually agreed upon upfront. Review progress regularly with your outsourced team, and reset expectations where needed. The clear, transparent communication and documentation of the project planning phase ensure that both parties keep the same beat throughout the FinTech outsourcing project lifecycle.

By addressing these challenges with strategic solutions, fintech software outsourcing can become a smooth and successful process, helping you maximize efficiency, security, and innovation in your fintech app development projects.

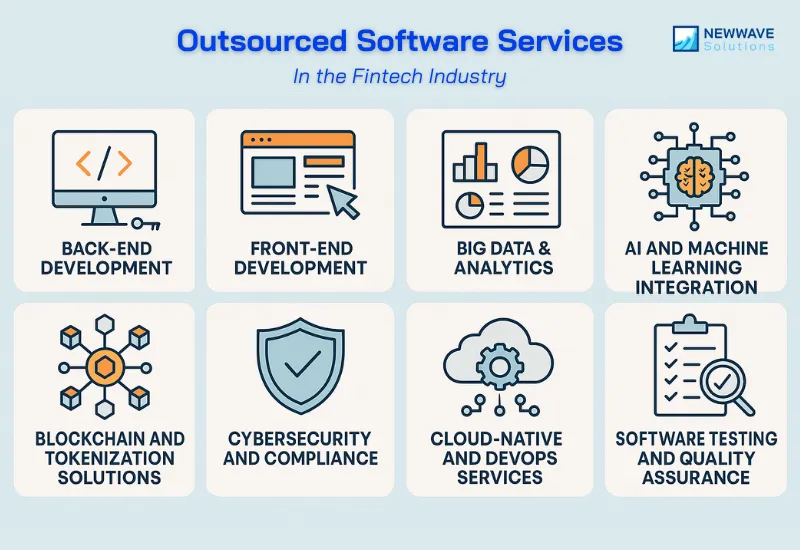

Common Outsourced Software Services in the Fintech Industry

Fintech companies outsource a wide range of software services to accelerate development and strengthen technical capabilities. These services support both new product development and modernization of existing platforms.

Each of the following categories plays a critical role in digital finance:

Back-End Development

Back-end systems form the foundation of fintech applications. Outsourcing this work helps companies build secure, scalable, and performant architectures. Services include API design, database engineering, microservices, payment integrations, authentication, and compliance-driven workflows. Experienced teams also help modernize legacy systems into cloud-ready, modular platforms.

Front-End Development

Fintech requires clean, intuitive, and secure user interfaces. Outsourcing front-end engineering allows companies to deliver smooth mobile and web experiences, responsive layouts, strong accessibility, and frictionless onboarding. UI frameworks and design systems ensure consistency across platforms.

Big Data and Analytics

Fintech success depends on rapid analysis of large datasets. Outsourced analytics services include data engineering, real-time dashboards, predictive analytics, anomaly detection, customer segmentation, and credit scoring systems. These capabilities support risk management, personalization, and strategic planning.

AI and Machine Learning Integration

AI drives fraud detection, chatbot support, loan decisioning, financial advisory, and personalized recommendations. Outsourced AI engineering also supports prescriptive analytics, automated compliance, and intelligent workflows.

Blockchain and Tokenization Solutions

Outsourced teams help build blockchain-enabled systems for digital assets, identity verification, tokenization, smart contracts, and secure cross-border transfers. These capabilities support new financial models and decentralized applications.

Cybersecurity and Compliance

Fintech applications must maintain strong protection. Outsourced cybersecurity services include penetration testing, threat monitoring, encryption, IAM, audit readiness, and compliance integration for standards such as PCI DSS, GDPR, SOC 2, AML, and KYC.

Cloud-Native and DevOps Services

Outsourcing cloud engineering accelerates migration to AWS, Azure, or GCP. Teams support containerization, infrastructure-as-code, CI/CD pipelines, observability, and resilient cloud architectures.

Software Testing and Quality Assurance

Testing is critical in fintech software development. Outsourced QA includes functional testing, API testing, security testing, performance testing, and automation. This ensures reliability and compliance before launch.

Things to Consider When Choosing an Outsourcing Partner

Choosing the right outsourcing partner determines the success of the project. Organizations should evaluate:

- Financial domain expertise: Knowledge of banking, payments, lending, insurtech, and regulatory requirements.

- Security certifications and compliance readiness: ISO 27001, GDPR alignment, secure development practices.

- Technical capabilities: Experience with cloud-native platforms, microservices, data engineering, AI, and advanced technologies.

- Strong communication and governance: Clear reporting, agile ceremonies, documentation standards, and transparency.

- Ability to scale: Immediate access to engineers with relevant skills and strong talent pipelines.

- Proven portfolio: Successful fintech apps, platforms, or enterprise solutions with measurable outcomes.

- IP ownership and code quality guarantees: Full transparency on intellectual property, code management, and delivery models.

A reliable outsourcing partner must deliver consistent quality, protect sensitive data, and align with long-term business goals.

How to Outsource Fintech Software Development Best

Fintech outsourcing works best when organizations follow a disciplined process. Financial platforms carry high expectations for security, compliance, reliability, and speed. This means the outsourcing cycle must be structured from the beginning. Clear governance, aligned requirements, and continuous communication ensure that complex financial products are delivered correctly, without delays or compliance issues.

Below is a refined, fintech-specific outsourcing framework that reduces risk and strengthens collaboration.

1. Define Goals and Requirements

Start by outlining your product vision, user profiles, financial workflows, compliance obligations, and risk boundaries. Fintech projects require precise understanding of:

- Core features such as payments, lending, onboarding, or identity verification

- Expected transaction volumes and performance needs

- Mandatory regulatory requirements (PCI DSS, GDPR, SOC 2, AML, KYC, Open Banking standards)

- Security thresholds and auditing policies

- Key metrics such as uptime, SLAs, and processing speeds

Clear requirements allow your outsourcing partner to design technical architectures, data flows, and integrations that fully support financial-grade performance and compliance.

2. Select the Right Country and Vendor

The right partner must combine strong engineering skills with financial domain knowledge. When selecting a country and vendor, evaluate:

- Availability of fintech-skilled engineers (AI, payments, blockchain, cloud, cybersecurity, risk modeling)

- Proven portfolio in banking, payments, trading, or lending

- Familiarity with compliance-driven development

- English proficiency and cultural fit

- Time-zone overlap for daily collaboration

- Security certifications and established governance practices

Fintech is high-stakes. Select vendors who can demonstrate a track record in secure, regulated environments and who offer predictable delivery processes.

For more insights of choosing right, please read to get more about best countries for offshore software development.

3. Establish a Detailed Contract and IP Agreement

Fintech outsourcing contracts must go beyond basic scope items. They should outline:

- Defined deliverables and technical expectations

- Acceptance criteria tied to financial workflows

- Code quality standards and documentation requirements

- Intellectual property ownership and source code access

- Data privacy, encryption, and security obligations

- Incident response and business continuity terms

For fintech, IP clarity and data protection are non-negotiable. Ensure all responsibilities and liabilities are documented before development begins.

4. Begin with a Discovery Phase

A structured discovery phase reduces costly misunderstandings. This step is crucial in fintech because of the complexity of financial logic, risk controls, and integrations with payment networks or financial institutions.

The discovery phase should include:

- Product and user journey mapping

- Regulatory review and compliance planning

- Technical architecture design (microservices, APIs, cloud infrastructure)

- Security threat modeling

- Data workflow and access control planning

- Project roadmap and sprint plan

This ensures both teams share a single vision of how the system will operate inside a regulated ecosystem.

5. Implement Strong Communication and Delivery Processes

Use agile sprints, weekly reviews, project dashboards, and clear documentation to maintain transparency and reduce miscommunication.

6. Monitor Progress and Adjust Continuously

Fintech requires consistent oversight. Monitoring should include:

- Sprint-level performance reviews

- Code quality checks and automated linting

- Security scans and penetration testing

- Load and stress testing for peak transaction periods

- Compliance audits across the lifecycle

- Early detection of scope creep or architectural risks

Make data-driven adjustments when needed. This prevents cumulative technical debt and ensures the system remains scalable and secure.

7. Focus on Testing, Security, and Compliance

In fintech, testing is not a final step — it is a continuous requirement. Your outsourcing partner should implement:

- Automated functional testing for high-risk features

- API and integration testing for banking partners

- Performance testing for real-time transaction loads

- Security testing for authentication, access control, and data privacy

- Regulatory compliance reviews before each major release

This guarantees the product remains stable, audit-ready, and aligned with evolving financial regulations.

Following this structured model allows fintech organizations to reduce outsourcing risk, accelerate product cycles, and deliver compliant financial software that performs reliably at scale.

FAQs

How do you reduce risks in fintech outsourcing?

To minimize the risks of fintech software outsourcing, it is highly relevant to find a reliable fintech software development company with great experience in this field. All that can be successful only under proper project management conditions and clear communications for the certainty of smooth collaboration.

The risks will be further mitigated when backed by strict security measures involving confidentiality agreements and data protection compliance. Additionally, regular progress and quality tracking will ensure quality delivery by the outsourcing partner.

What is the difference between SaaS and fintech?

SaaS Development and FinTech are both part of the digital transformation, though they are oriented towards different directions: SaaS stands for software delivered over the cloud; as such, it provides subscription-based services in business needs, like customer management or project collaboration.

Fintech, in turn, describes only technology that enables and automates services related to banking, investment, or payments. The use of SaaS can be done in applications that pertain to fintech, but they do not mean the same.

What is the most commonly used fintech service?

The most used fintech services include mobile payments, digital wallets, peer-to-peer lending, and online banking. All these services are restructuring how people manage their finances, invest, and make payments. Mobile wallets and digital wallets, such as Apple Pay and PayPal, respectively, are among the most widely used fintech applications due to the convenience and security of such transactions.

What is the best framework for fintech apps?

The right selection of the framework is of prime importance for developing a scalable and secure fintech application. React Native is in demand for cross-platform mobile development, while Angular works perfectly for web applications.

Node.js and Django are widely used to build backend services owing to their speed and scalability. The best framework for the fintech app shall depend on what features are intended to be performed with the fintech app, what user experience is desired, and what security shall be addressed.

Why Newwave Solutions for Your Outsource Software Fintech?

Fintech companies need a partner with strong engineering capabilities, deep domain understanding, security discipline, and a commitment to consistent delivery. This is where Newwave Solutions becomes a powerful choice.

We bring more than a decade of experience delivering digital solutions across banking, payments, lending, investment, and insurance. Our teams build secure, compliant, and scalable financial platforms with cloud-native architectures, advanced analytics, and AI-enabled features.

Our expertise covers the entire lifecycle from idea to launch and continuous improvement. Whether you require fintech software development services, modernization of legacy systems, advanced integration, or full product engineering, we deliver predictable outcomes through an agile and transparent model.

Clients choose us because:

- We understand financial domain challenges such as fraud prevention, risk modeling, regulatory compliance, and secure integrations with payment gateways or banking systems.

- We provide global talent with strong English skills, senior engineers, and proven fintech expertise.

- We apply strong security practices, backed by ISO 27001 and structured governance.

- We deliver faster, ensuring your product releases on time without compromising on quality.

- We support full-cycle innovation, including design, data engineering, AI, blockchain, cloud, and QA.

Our teams in Vietnam offer cost efficiency without sacrificing quality, making us a strong alternative for companies considering software outsourcing Vietnam. We also support companies expanding their offshore software development strategy with predictable delivery, clear processes, and excellent communication.

If your business requires modernization, product scaling, data-driven features, or secure integrations, we provide the stability and expertise needed to build long-term value. Our capabilities also extend to advanced technologies, including blockchain technology, enabling innovation across digital assets, tokenization, and secure transactions.

Newwave Solutions stands ready to support your journey with secure, scalable, and modern financial solutions. Whether you need application development, modernization, analytics, cloud engineering, or complete financial software services, we deliver reliable outcomes through agile and compliant processes.

If you are searching for a trusted partner to build, scale, or transform your fintech product, Newwave Solutions is here to help. Our proven experience, global talent, and strong commitment to excellence make us a long-term partner for innovation, growth, and success in digital finance.

To Quang Duy is the CEO of Newwave Solutions, a leading Vietnamese software company. He is recognized as a standout technology consultant. Connect with him on LinkedIn and Twitter.

Read More Guides

Get stories in your inbox twice a month.

Let’s Connect

Let us know what you need, and out professionals will collaborate with you to find a solution that enables growth.

Leave a Reply