e-Wallet App Development in 2024 | In-Depth Guide

As digital wallets have taken over the market, gone are the days of carrying cash in your wallet all the time. In North America alone, the number of digital payment and e-Wallet app users is predicted to double by 2025. Let’s explore what digital wallets mean, why your business needs e-Wallet app development, and how to create a mobile wallet app for your business.

Table Of Contents

ToggleWhat is an e-Wallet App?

In simple words, you can think a digital wallet is just like a normal wallet in your pocket, but it does not store any physical currency.

A digital wallet or e-Wallet app is a type of mobile app that allows users to securely store, send, and receive digital money like Bitcoin, Ether, and Ripple with ease. This type of app is a convenient and secure way to manage one’s finances. eWallet app allows users to track their expenses, set up budgeting goals, and even invest in stocks and mutual funds. It is also a great way to make payments and transfers without the inconvenience of cash and cards.

Benefits of e-Wallet App Development

Companies such as Google and Amazon are creating their own digital wallets (Google Pay & Amazon Pay) that their customers can use to make payments. They get profit from every transaction done by the user from their E-wallets. In return, these companies will give multiple lucrative offers that customers can use with their wallets. Below are some of the e-Wallet app development benefits:

- Convenience. eWallet apps make it easy to manage one’s finances. They allow users to make payments, transfers, and investments without having to carry cash or coins.

- Security. Mobile wallet apps are highly secure and use advanced encryption technology to keep user data safe. It also has two-factor authentication to ensure that only authorized users can access the app.

- Cost Savings. Digital wallet apps can help users save money by eliminating the need for physical cash or coins. It also eliminates the need for expensive bank fees and transaction costs.

- Flexibility. eWallet apps allow users to store, make payments, and transfer different types of digital currencies. This makes it a great option for those looking to make international payments and transfers.

- Accessibility. The eWallet app is accessible from anywhere with an internet connection. This makes it easy for users to manage their finances from anywhere in the world.

Best Types of e-Wallet Apps

Digital wallet app development can be used to create e-Wallet apps for a variety of purposes. Here are some of the best types of e-Wallet apps that you should know:

- Payment Wallet Apps. These apps allow users to store their payment information and make payments with ease. They are usually used for online shopping and can be linked to a bank account or credit card.

- Investment Apps. These are apps that allow users to invest in stocks, mutual funds, and other investments. They are usually used by investors and can be linked to a bank account or credit card.

- Digital Currency Apps. These are apps that allow users to store and transact with digital currencies such as Bitcoin, Ether, and Ripple. They are often used by traders and investors and can be linked to a bank account or credit card.

- Money Transfer Apps. These are apps that allow users to send money to other users or recipients. They are often used for international money transfers and can be linked to a bank account or credit card.

Step-by-step Guide for e-Wallet App Development

Up to now, you probably understand what is e-wallet apps and their unlimited potential. However, what does it take to create an outstanding digital wallet app development? As a rule, any eWallet mobile app development project will include the following stages:

Step 1: The Discovery Phase

This stage should be performed by professional Business Analysts who diligently estimate whether your idea is both economically profitable and technically feasible. The BAs will examine your customer’s vision of the future app with consideration like your business’s ultimate goal, time, and budget limits. This project might take up to one month. Overall, the most significant deliverables at this stage are the product’s well-structured functional and non-functional requirements and a detailed roadmap.

Step 2: Architecture and Design

In the early stages of digital wallet app development, your IT architects create an in-depth structure for their applications and plan for integration with third-party systems. Skillful designers transform it into visual prototypes that allow for making secure, seamless transactions in no time. This stage can take up to one month.

Step 3: Start e-Wallet App Development

The design of your app’s front end and back end is completed at this point. The front end is all about the app’s visible part, which shows what it looks like to users. Responsive design and seamless adoption are keys to ensuring a user-friendly experience on all devices and screen sizes whether it’s desktop or mobile. The back end, on the other hand, is where you work with databases and APIs that enable transactions with a banking network. This stage can take up to six months of development depending on your project’s complexity.

Step 4: Testing Stage

Testing usually takes place before product release. It’s aimed at ensuring that the app functions as planned and specified by the requirements, and all inconsistencies are promptly eliminated. At this point, it’s important to test your e-Wallet app security. Since e-Wallet app development holds sensitive information about clients and banking, all security-related features must be thoroughly tested here.

Step 5: Support and Maintenance Stage

This is the process of upgrading and improving your end product that your e-Wallet app development company should carry out as long as the product is used. Such post-release cooperation with the e-Wallet app development company ensures that your digital wallet app remains highly competitive and up-to-date in the context of changing markets and evolving technology.

Key Features of eWallet Apps

Here are some key features that make it easy to use and secure your mobile wallet app development:

- Secure Login: The app must have a secure login feature that requires two-factor authentication. This ensures that only authorized users can access the app.

- User Profile: The app must have a user profile feature that allows users to store their personal information, payment information, and other data.

- Payment Gateway: The app must have a payment gateway feature that allows users to make payments and transfers with ease.

- Transaction History: The app must have a transaction history feature that allows users to track their transactions and expenses.

- Push Notifications: The app must have a push notification feature that allows users to receive notifications about payments, transfers, and other activities.

- Data Encryption: The app must have data encryption to ensure that all user data is secure and protected.

- Multi-Currency Support: The app must have multi-currency support to allow users to make payments and transfers in different currencies.

e-Wallet App Development Challenges

While the eWallet app development process is relatively straightforward, there are a few challenges that developers may encounter. The first mobile wallet app development challenge to start with is security. Your eWallet app must be secure and must be utilized with advanced encryption technology to protect 100% of user data. After that, your project must also have two-factor authentication to ensure that only authorized users can log in to the account.

Next, your e-Wallet app development also must comply with all applicable laws and regulations. This includes the Payment Card Industry Data Security Standard (PCI DSS) and the General Data Protection Regulation (GDPR).

Now, let’s move on to the technical part which is scalability. Your eWallet app must be able to handle a large number of users and transactions since there will be an increase in users in the long run. So, it must be able to handle spikes in traffic and scale up as needed. This will involve coding or implanting connection support. Finally, the e-Wallet app must be able to integrate with other systems and services. This includes payment processors, banks, and other third-party services.

Choose an e-Wallet App Development Company

There are a number of software development companies that specialize in developing Fintech or eWallet apps. These organizations have the expertise and experience to develop an eWallet app that meets the user’s requirements and budget.

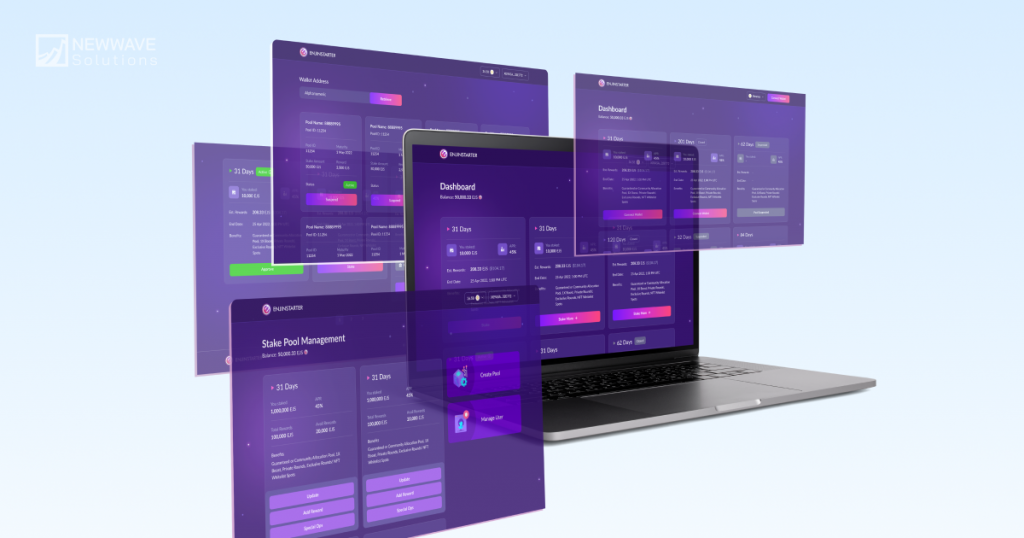

Newwave Solutions has extensive experience in developing e-Wallet apps. Check out our latest digital wallet app development portfolio in 2022. Best of all, we also have one of the most competitive prices for e-Wallet app development compared to other software companies. And, of course, we also include the cost of ongoing maintenance and support as well.

Read on to understand more about our Fintech app development process!

Conclusion

The e-Wallet app is the way to manage one’s finances nowadays. It is secure, convenient, and cost-effective. If you are looking to develop an e-Wallet app, you should consider the different aspects discussed in this article. Then, make sure to choose an experienced e-Wallet app development company that has the expertise and experience to develop an app that meets your requirements and budget like Newwave Solutions.

Tags

To Quang Duy is the CEO of Newwave Solutions, a leading Vietnamese software company. He is recognized as a standout technology consultant. Connect with him on LinkedIn and Twitter.

Table Of Contents

Toggle