A Complete Guide to eWallet App Development in 2026

As digital wallets have taken over the market, gone are the days of carrying cash in your wallet all the time. In North America alone, the number of digital payment and e-Wallet app users is predicted to double by 2026.

In this article, we will discuss what eWallet apps are, why your business needs eWallet app development, the main types of eWallet apps, and how to create an eWallet app for your business.

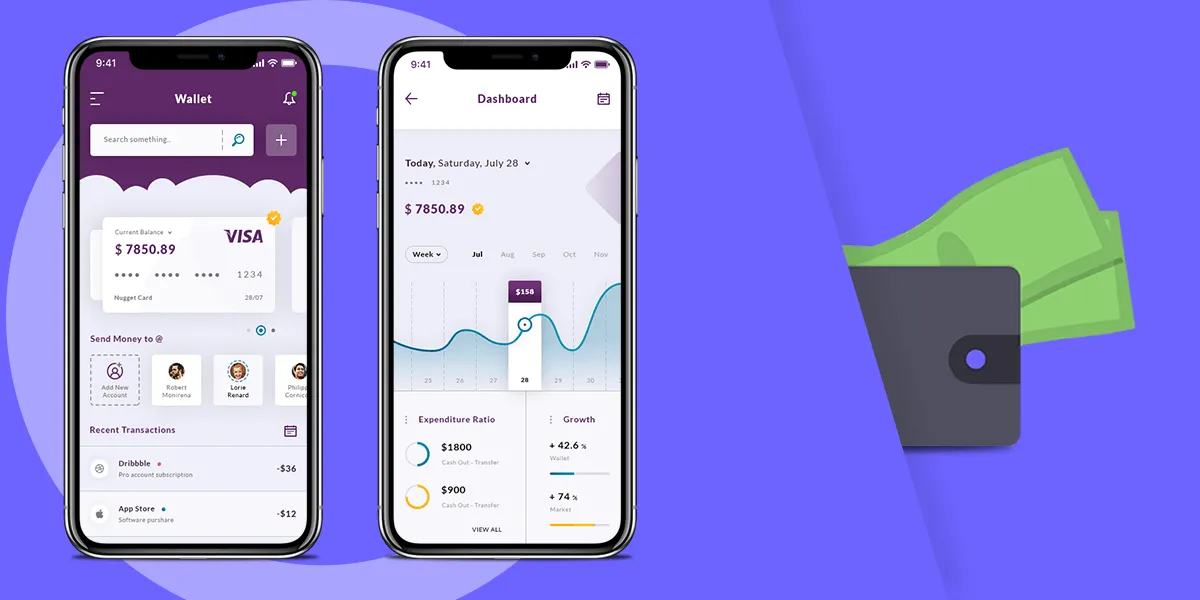

What is an e-Wallet App?

In simple words, you can think of a digital wallet is just like a normal wallet in your pocket, but it does not store any physical currency.

A digital wallet or e-Wallet app is a type of mobile app that allows users to securely store, send, and receive digital money like Bitcoin, Ether, and Ripple with ease. This type of app is a convenient and secure way to manage one’s finances. The eWallet app allows users to track their expenses, set up budgeting goals, and even invest in stocks and mutual funds. It is also a great way to make payments and transfers without the inconvenience of cash and cards.

How Do eWallet Apps Work?

At their core, eWallet apps operate as digital intermediaries that securely store users’ payment credentials and facilitate transactions in a few taps. The following process outline sets out the fundamental operational flow of a typical eWallet application:

-

User registration and account setup: The user downloads the eWallet app, registers an account by entering personal details, and links a payment method such as a bank account, card, or other wallet. Most apps also verify identity using SMS, email, or biometric checks to ensure security and compliance.

-

Data encryption and tokenisation: Once the user’s payment credentials are added, the wallet app encrypts that data and replaces sensitive information with unique tokens for each transaction. This process ensures that the actual card or bank data is never exposed in the transaction flow.

-

Transaction initiation and authorisation: When the user initiates a payment—via scan code, tap-to-pay or “send money” command—the wallet triggers the tokenised transaction, sends the request through secure backend systems and awaits authorisation from the payment network or bank.

-

Settlement and confirmation: Following authorisation, the transaction is settled either in fiat currency or digital currency, funds are transferred, and the user receives confirmation of the successful payment or transfer via in-app notification or SMS/email.

-

Transaction history, receipts, and analytics: The app stores a record of every transaction with status, timestamp, and details for transparency and audit. Users and businesses can review history, download statements, or analyse spending patterns, which supports trust and accountability.

>>>Read more: Digital Wallet App Powered by Blockchain for Smart Staking

Why choose eWallet App Development?

Companies such as Google and Amazon are creating their own digital wallets (Google Pay & Amazon Pay) that their customers can use to make payments. They get profit from every transaction done by the user from their E-wallets. In return, these companies will give multiple lucrative offers that customers can use with their wallets. Below are some of the eWallet app development benefits:

- Convenience: eWallet apps make it easy to manage one’s finances. They allow users to make payments, transfers, and investments without having to carry cash or coins.

- High Security: Mobile wallet apps are highly secure and use advanced encryption technology to keep user data safe. It also has two-factor authentication to ensure that only authorized users can access the app.

- Cost Savings: Digital wallet apps can help users save money by eliminating the need for physical cash or coins. It also eliminates the need for expensive bank fees and transaction costs.

- High Flexibility: eWallet apps allow users to store, make payments, and transfer different types of digital currencies. This makes it a great option for those looking to make international payments and transfers.

- Accessibility: The eWallet app is accessible from anywhere with an internet connection. This makes it easy for users to manage their finances from anywhere in the world.

5 Main Types of eWallet Apps

To help enterprises visualise the kinds of eWallet solutions out there and what they really do, below is a summary of some of the most common eWallet app types and their core purposes.

- Closed-loop wallet apps: These wallets are designed for use within a single brand or merchant ecosystem, meaning users can spend only at the issuer’s outlets or platform. Such a model strengthens brand loyalty and keeps user activity tightly controlled within the merchant’s environment.

- Semi-closed wallet apps: These wallets allow users to make payments at a set of partnered merchants and outlets, while still being limited compared to fully open systems. This type gives businesses flexibility to expand merchant coverage while maintaining control over the network and user experience.

- Open wallet apps: These wallets support transactions across multiple merchants, banks, and user accounts, offering broad usage including fund transfers and cash withdrawals. The open nature helps maximise user adoption, cross-border transactions, and scalability of the service.

- Cryptocurrency wallet apps: These specialised wallets focus on the storing, sending, and receiving of digital assets like Bitcoin or Ethereum, often built on blockchain infrastructure and heightened security layers. Such apps appeal to users engaged in the crypto economy and support entirely new financial behaviours.

- IoT-enabled or wearable wallet apps: These wallets integrate with wearable devices, smart vehicles, or IoT ecosystems to enable seamless payments via smart watches, connected cars, or even smart home devices. This type enhances convenience, aligns with the “tap & go” paradigm, and supports emerging user expectations for ambient finance.

Step-by-step Guide for eWallet App Development

Up to now, you probably understand what e-wallet apps are nd their unlimited potential. However, what does it take to create an outstanding digital wallet app development? As a rule, any eWallet mobile app development project will include the following stages:

Step 1: The Discovery Phase

This stage should be performed by professional Business Analysts who diligently estimate whether your idea is both economically profitable and technically feasible. The BAs will examine your customer’s vision of the future app with considerations like your business’s ultimate goal, time, and budget limits. This project might take up to one month. Overall, the most significant deliverables at this stage are the product’s well-structured functional and non-functional requirements and a detailed roadmap.

Step 2: Architecture and Design

In the early stages of digital wallet app development, your IT architects create an in-depth structure for their applications and plan for integration with third-party systems. Skillful designers transform it into visual prototypes that allow for making secure, seamless transactions in no time. This stage can take up to one month.

Step 3: Start eWallet App Development

The design of your app’s front end and back end is completed at this point. The front end is all about the app’s visible part, which shows what it looks like to users. Responsive design and seamless adoption are keys to ensuring a user-friendly experience on all devices and screen sizes whether it’s desktop or mobile. The back end, on the other hand, is where you work with databases and APIs that enable transactions with a banking network. This stage can take up to six months of development, depending on your project’s complexity.

Step 4: Testing Stage

Testing usually takes place before product release. It’s aimed at ensuring that the app functions as planned and specified by the requirements, and all inconsistencies are promptly eliminated. At this point, it’s important to test your e-Wallet app security. Since eWallet app development holds sensitive information about clients and banking, all security-related features must be thoroughly tested here.

Step 5: Support and Maintenance Stage

This is the process of upgrading and improving your end product that your eWallet app development company should carry out as long as the product is used. Such post-release cooperation with the eWallet app development company ensures that your digital wallet app remains highly competitive and up-to-date in the context of changing markets and evolving technology.

7 Key Features of eWallet Apps

Here are some key features that make it easy to use and secure your mobile wallet app development:

- Secure Login: The app must have a secure login feature that requires two-factor authentication. This ensures that only authorized users can access the app.

- User Profile: The app must have a user profile feature that allows users to store their personal information, payment information, and other data.

- Transaction History: The app must have a transaction history feature that allows users to track their transactions and expenses.

- Push Notifications: The app must have a push notification feature that allows users to receive notifications about payments, transfers, and other activities.

- Data Encryption: The app must have data encryption to ensure that all user data is secure and protected.

- Multi-Currency Support: The app must have multi-currency support to allow users to make payments and transfers in different currencies.

- Payment Gateway: The app must have a payment gateway feature that allows users to make payments and transfers with ease.

Top 5 eWallet apps in the Marketplace

1. PayPal

PayPal is a global payments platform founded in 1998 and now used by hundreds of millions of individuals and businesses for online transactions. The app has become a go-to eWallet solution for cross-border transfers, e-commerce checkouts, and digital commerce partnerships.

Key services:

-

Sending and receiving money globally with multi-currency support.

-

Checking out online at millions of e-commerce sites and marketplaces.

-

Business invoicing and payment collection for small & large merchants.

-

Linkage of bank accounts, debit/credit cards, and PayPal balance for seamless transactions.

2. Venmo

Venmo, owned by PayPal, is a U.S.-based mobile payment eWallet launched in 2009, widely adopted by younger users for peer-to-peer transfers and social payment sharing. The app stands out for its social feed style and ease of splitting bills among friends.

Key services:

-

Peer-to-peer transfers via phone number, username, or QR code.

-

Bill splitting and shared expenses among groups of friends.

-

Instant-transfer feature to pull money into a linked bank or card.

-

Integration with select merchants for in-app and in-store purchases.

3. Apple Pay

Apple Pay is Apple’s digital wallet solution, introduced in 2014, that allows iPhone, iPad, and Apple Watch users to make contactless payments via NFC and in-app purchases. The app benefits from deep integration with Apple hardware and emphasises security and convenience.

Key services:

-

Tap-to-pay at physical stores using an iPhone or an Apple Watch via NFC.

-

In-app and online checkout support in Safari and apps.

-

Linking of Apple Card, credit/debit cards, and loyalty cards within the wallet.

-

Biometric authentication (Touch ID / Face ID) and device-specific tokenised payments for security.

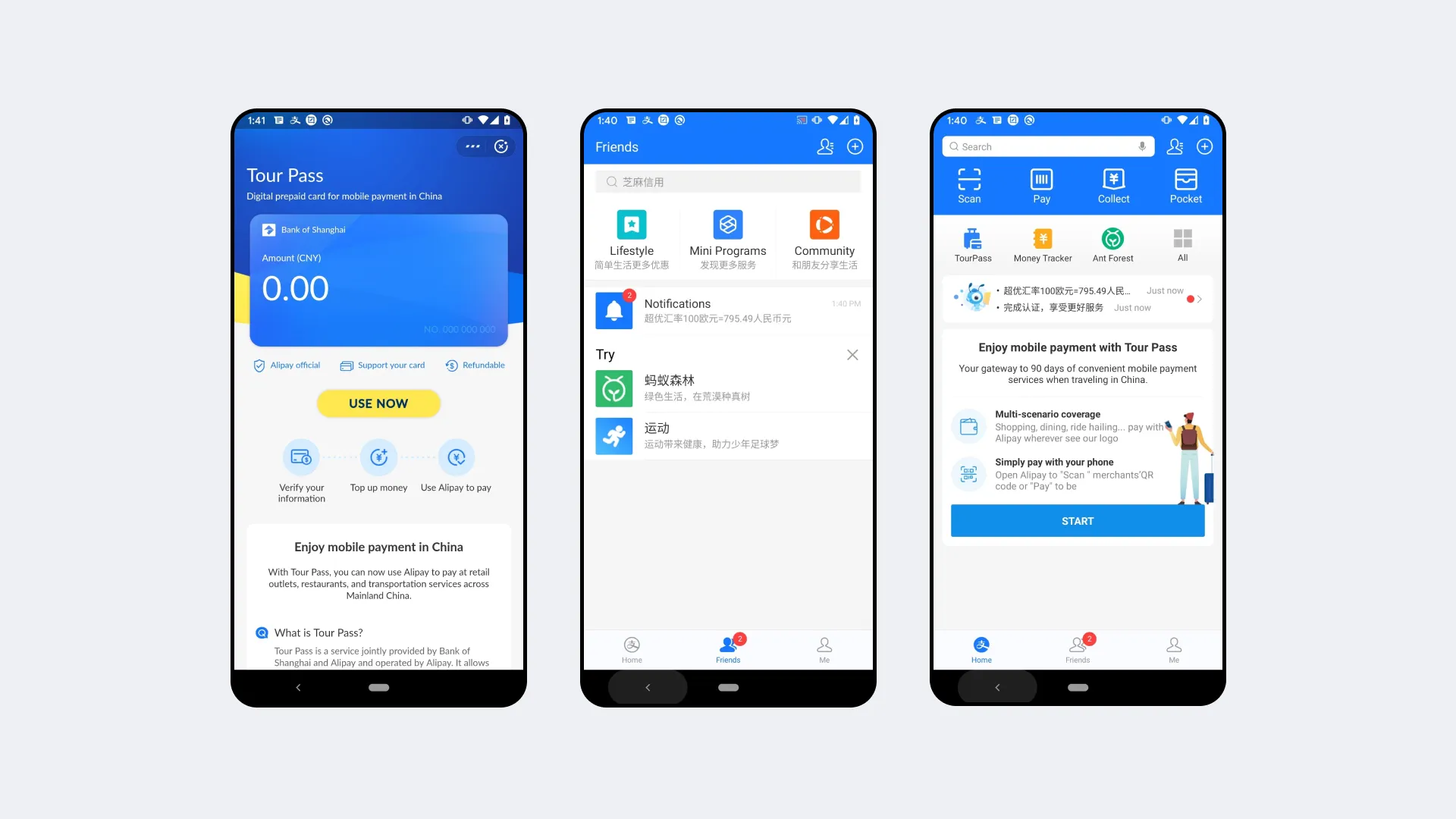

4. Google Pay

Google Pay is Google’s digital wallet offering, which brings together payments, peer-to-peer transfers, and store purchases across Android devices and the web. The app serves a wide global user base and supports both consumer and business payment use cases.

Key services:

-

Tap-to-pay at physical stores on Android and wearables.

-

Send and receive money to friends and family via phone number.

-

Store digital loyalty cards, tickets, and boarding passes within the wallet.

-

Online checkout and integration with merchants via Google’s payment APIs.

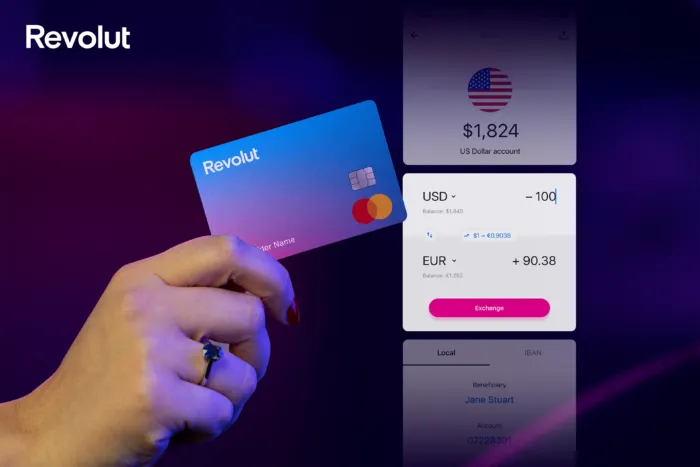

5. Revolut

Revolut is a fintech software development eWallet and banking app launched in the UK in 2015, offering global money transfers, multi-currency wallets, and crypto-asset services as part of its offering. The platform has gained popularity for its value-added financial features and travel-friendly payment capabilities.

Key services:

-

Holding and spending multiple currencies through one app with favourable exchange rates.

-

Transferring funds internationally with minimal fees and fast processing.

-

Buying, holding, and tracking cryptocurrencies within the wallet.

-

Spending in-app and via connected card globally with travel-friendly benefits.

Newwave Solution – a reliable eWallet App Development Company

If you are planning to develop an eWallet app but are unsure where to start, hiring professional services from Newwave Solutions is a valuable solution. With over 14 years of experience in providing financial software development services, Newwave has supported numerous businesses in building and growing their own E-Wallet apps successfully.

E-Wallet App Development Services by Newwave Solutions

-

Closed Wallets are designed for environments where users can only transact within a specific ecosystem, ensuring high security and focused usability.

-

Semi-Closed Wallets allow users to perform transactions with a limited set of merchants and receive funds from external sources, providing moderate flexibility and control.

-

Open Wallets enable transactions across a wide network, supporting peer-to-peer transfers and payments to any merchant, delivering maximum versatility.

-

Mobile Wallets facilitate seamless payment processing directly from users’ smartphones, enhancing accessibility and convenience for consumer transactions.

-

Web Wallets offer browser-based digital wallet solutions, allowing easy access from any internet-enabled device without app installation.

-

Merchant Wallets specializes in managing in-store and online payments for businesses, integrating various payment options to streamline checkout processes.

-

Crypto Wallets handle the secure storage and management of cryptocurrencies, supporting multi-chain assets with advanced encryption technology.

-

IoT & Wearable Wallets integrate payment capabilities into connected devices and wearables, expanding the reach of digital payments into new user experiences.

Why Choose Newwave Solutions?

Here are several main reasons why you should choose our eWallet app development services:

-

Multi-Chain Support allows management of assets across multiple blockchains like TON, Bitcoin, and EVM-based chains, giving wide digital currency flexibility.

-

Self-Custodial Security ensures users maintain full control over private keys using institutional-grade encryption and security protocols for maximum protection.

-

Transaction Optimization through intelligent gas routing and fee monitoring helps reduce transaction costs and increase efficiency.

-

DeFi Access includes built-in decentralized finance tools for staking, yield farming, and liquidity participation, enhancing investment opportunities.

-

NFT Integration provides native functionalities such as NFC ticketing, verification, and NFT-based rewards to leverage emerging digital asset trends.

-

Cross-Platform Parity guarantees a consistent user experience across web, mobile, and browser extension platforms, promoting usability.

-

Real-Time Monitoring delivers live alerts, portfolio tracking, and analytics dashboards for effective wallet management.

-

Microservices Architecture supports modular backend development to ensure scalability during periods of peak traffic and usage.

-

Customizable Framework offers tailored wallet features designed to meet specific industry requirements and enterprise needs.

Conclusion

The e-Wallet app is the way to manage one’s finances nowadays. It is secure, convenient, and cost-effective. If you are looking to proceed with the eWallet app development, you should consider the different aspects discussed in this article. Then, make sure to choose an experienced eWallet app development company that has the expertise and experience to develop an app that meets your requirements and budget, like Newwave Solutions.

Contact Information:

- Head Office (Hanoi): 1F, 4F, 10F, Mitec Building, Cau Giay Ward, Hanoi City, Vietnam

- Branch Office (Tokyo): 1chōme118 Yushima, Bunkyo City, Tokyo 1130034, Japan

- Hotline: +84 985310203

- Website: https://newwavesolution.com

- Email: [email protected]

To Quang Duy is the CEO of Newwave Solutions, a leading Vietnamese software company. He is recognized as a standout technology consultant. Connect with him on LinkedIn and Twitter.

Read More Guides

Get stories in your inbox twice a month.

Let’s Connect

Let us know what you need, and out professionals will collaborate with you to find a solution that enables growth.

Leave a Reply